Business Line of Credit that gives you access to funds when you need it

Get instant access to revolving credit with competitive terms, and the best rates for your business.

Or give us a call at (737) 256 7458

Fast and easy funding that grows with your business

Draw funds at any time and use in any way you like

Amounts from $50K - $750K

Unlimited terms and incredible rates

Soft credit pull that won't affect your credit score

How does it work?

Apply Online

Submit basic information about your business and get a decision in less than 24hrs.

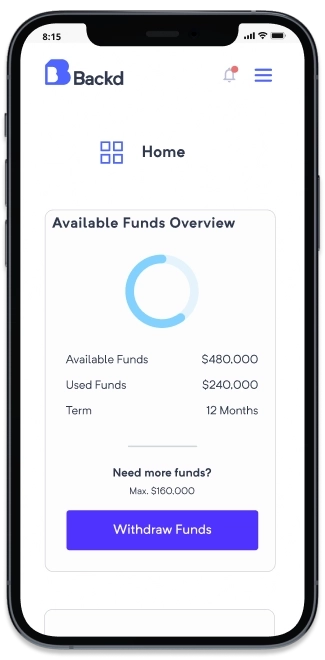

Draw Funds

Access your funds through our dashboard and track your draws and payments.

Make Payments

Repay weekly in 6 months or 12 months.

Get More Funds

Your credit automatically reloads as you pay your balance.

What do you need to get started?

Apply in minutes with no obligations and no hard credit pulls.

What do we require?

- 2 year in business minimum

- 650+ FICO score

- $100K+ monthly revenue

- A business bank account

- A U.S.-based business

What is a Business Line of Credit?

A business line of credit is a flexible loan where funds can be withdrawn whenever needed, as long as the credit limit offered isn't exceeded. Interest then accumulates on the funds that are drawn, usually at a variable rate.

For these reasons, a business line of credit can be useful for small-business owners looking to cover short-term needs, such as payroll, equipment purchases, etc.

Apply in 3 minutes or less...

With no impact to your credit score!

We want to make business funding as easy as possible. Our fast, online application process, same day decisions, competitive rates, and flexible terms make it happen.